Written by

Stephen Kerr, Bel Age Medias, LLC

******************************************

– 5 MINUTE READ (700 words) –

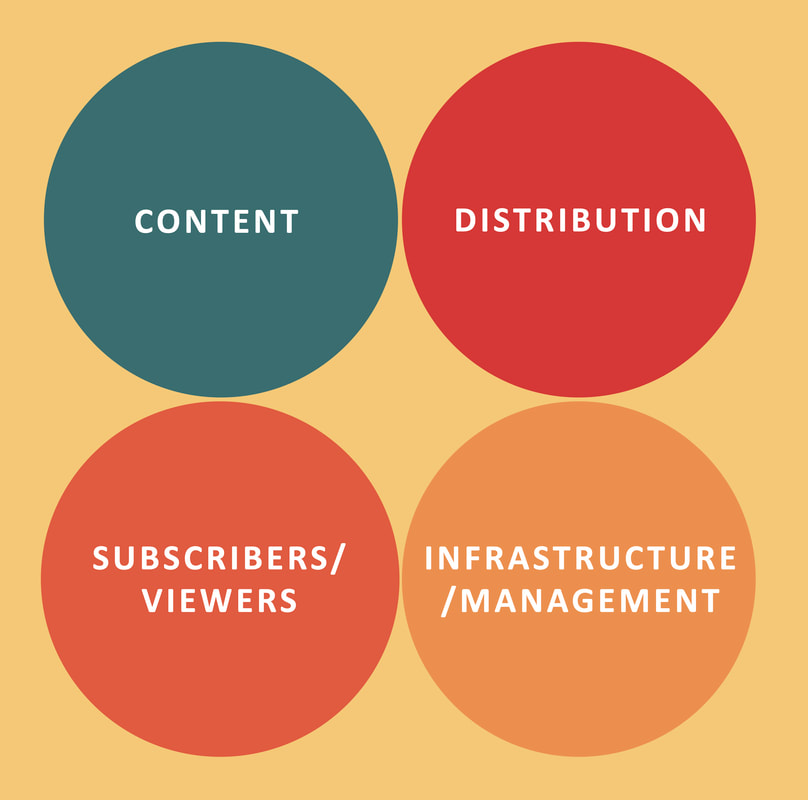

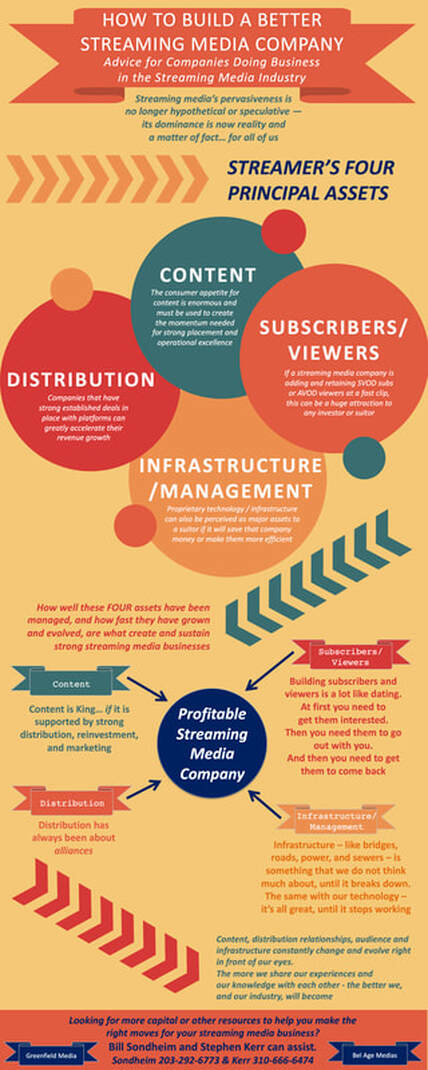

Four factors that add value to any distributor or content library:

- Owning the content;

- New releases of proprietary titles;

- Growing international distribution; and

- Gross margins above 40%.

Almost all the companies, that we know, are now a hybrid film distributor, producer, and FAST channel operator. Whether their content is theatrical, classic, documentary, or educational - most “home media” distributors today are highly diversified.

RSS Feed

RSS Feed